Sxcoal Issue 51# | China thermal, coking coal prices extend fall; met coke stable

Thermal coal prices drop at major northern Chinese ports, coking coal falls on bearish sentiment, while met coke stabilizes...

The 1st Global Coking Coal Conference would invite industry leaders and experts to delve into the synergies and competition between China and global coking coal markets, analyze technological pathways and market opportunities under green transition pressures, and assess the impacts of geopolitical factors, cost volatility, and trade policies.

Thermal Coal

Portside Market: Thermal coal prices at major northern Chinese ports continued to weaken due to lukewarm demand from end users, who are seeking aggressive discounts. Power plants are burning less coal during the off-season and have sufficient stockpiles. Coal inventories at key ports like Qinhuangdao, Jingtang, and Caofeidian totaled 29.3 million tonnes as of April 25, down 2.0% week on week but 35.1% higher than the year-ago level.

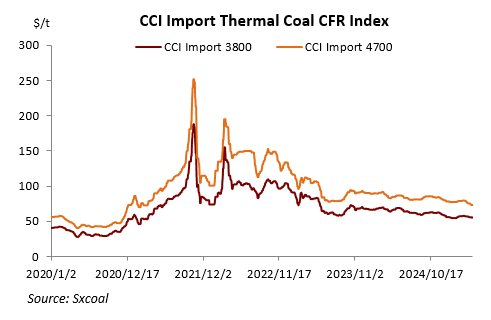

Price Trends: The CCI index for 5,500 Kcal/kg NAR domestic spot coal dropped to 662 yuan/t FOB northern China ports on April 25, down 8 yuan/t week on week. The CCI 5500 Import index fell to $83.3/t CFR southern China ports, declining $0.4/t compared to the previous week.

Market Sentiment: Market sentiment remained cautious due to weak off-season demand from power plants and insufficient essential buying from other sectors. Participants anticipated further price declines but believed cost support will limit substantial drops. The trading standstill continued, with many sellers adopting a wait-and-see approach due to high costs and weak prices.

Import Market: Trading activities in the seaborne import market remained subdued. Chinese traders avoided purchasing Indonesian coal due to unattractive prices. Australian thermal coal liquidity stayed moderate, but high-CV grades remained uncompetitive compared to domestic coal. Chinese utilities increased purchases of Russian mid-CV coal but faced issues with high-CV grades due to trace elements non-compliance.

More details in our latest weekly thermal coal review, incl. our weekly survey on thermal coal mines, market changes and updates on coal consumption in domestream sectors. »CLICK HERE

Coking Coal

Market Overview: China's coking coal market experienced a decline in prices last week due to a bearish market outlook. Buyers were cautious in their purchasing activities, focusing on digesting existing stocks and avoiding high-priced cargoes. This led to a generally weak market sentiment, with some miners cutting offers by 20-30 yuan/t for certain grades of coking coal.

Supply and Demand: While previously idled mines resumed operations, overall coking coal production slightly decreased due to underground rectifications and completion of monthly tasks. Raw coking coal output at 363 Sxcoal-surveyed mines dipped by 0.05% week on week to 12.56 million tonnes. Steel mills showed low buying interest due to unclear macroeconomic conditions. Coking plants focused on inventory clearance, making only small, essential purchases.

Inventory: Inventory levels at mines and coking plants remained relatively low but manageable. Raw coking coal stocks at surveyed mines increased by 2.40% week on week, while washed coal stocks decreased by 4.16%.

Prices: Specific grades such as Linfen low-sulfur primary coking coal (S 0.5%, GRI 80-85) declined by 30 yuan/t to 1,300 yuan/t, while Changzhi lean coking coal (S 0.4%, GRI 5) dropped by 20 yuan/t to 890 yuan/t. Online auctions faced setbacks with higher failure rates and more price cuts.

Mongolian Coal: Daily customs clearance of Mongolian coal averaged 705 trucks over April 21-24, down 403 trucks week on week due to environmental protection measures and stricter customs inspections. Spot prices for Mongolian 5# raw coal under long-term contracts were around 820-840 yuan/t.

Seaborne Imports: Despite the reopening of the Appin West mine, supply constraints persisted due to disruptions at other Australian mines. Indian steel price surges and improved end-user margins supported coking coal prices. Australian Goonyella hard coking coal traded at $191-192.2/t FOB, up $2-3.2/t week on week.

More details in our latest weekly coking coal review, incl. our weekly survey on coking coal mines, market dynamics, etc. »CLICK HERE

Met Coke

Market Overview: Chinese metallurgical coke prices remained stable last week, supported by active production and smooth sales to steel mills. Coke-making profit margins improved due to stable coke prices and declines in certain coking coal grades. Despite a second price hike proposal by some coke producers, many steelmakers were reluctant to accept it due to market uncertainty.

Production side: Coking plants maintained high operation rates to meet rising demand from steel mills, with the capacity utilization of Sxcoal-surveyed plants increasing slightly to 75.3% last week. However, signs of inventory accumulation emerged due to cautious buying from steelmakers, slowing the destocking pace at coking plants.

Port: Coke traders actively offloaded cargoes at eastern transfer ports, leading to a significant decline in portside stocks. However, steel mills resisted high-priced resources, making it difficult to liquidate high-cost cargoes.

Demand side: Steel production activity continued to increase last week, supported by higher profits and resilient export orders. Steel prices moved upward as U.S.-China trade tensions eased slightly. The sustainability of high molten iron production remains uncertain due to seasonal demand peaks and lackluster global steel trades.

More details in our latest weekly met coke review, incl. our weekly survey on coking plants, market dynamics, etc. »CLICK HERE

The above updates are also available in our newsletter China Coal Weekly, which provides in-depth analysis and commentaries, as well as market highlights in coal and related industries.

Meanwhile, our Weekly EXCEL Supplement keeps you updated on the CCI Thermal and Coking Coal, Met Coke indexes, prices at main production areas and transfer ports, key weekly and monthly statistical data on coal and related industries (production, stocks, import & exports, etc.).

If you wish to take a trial, please sign up HERE.