Sxcoal Issue 48# | China's thermal and coking coal markets continue to fall; met coke slightly improves

China's thermal and coking coal markets still on the fall last week, and met coke improves moderately after the 10th price cut...

China's thermal coal market continues to face downward pressure from weak demand, high inventories, and falling prices, though supply constraints from safety inspections and potential policy adjustments may temper near-term declines. The coking coal market remains cautious amid volatile demand and subdued import activity, while coke prices are expected to stabilize ahead of the "Two Sessions" on policy optimism but lack strong upward momentum due to soft cost and demand conditions.

Thermal Coal

Portside Market: The portside thermal coal market in China continued to decline last week due to weak transactions and buyers pushing for lower prices. Coal stocks at major northern ports such as Qinhuangdao, Jingtang, and Caofeidian rose by 0.42% week on week to 27.38 million tonnes on February 28, surging 33.35% year on year. Sellers were compelled to accept lower prices to reduce inventory pressure.

Price Trends: The Fenwei CCI index for 5,500 Kcal/kg NAR domestic spot coal fell to 699 yuan/t FOB northern China ports with VAT on February 28, down 29 yuan/t week on week. The CCI 5500 Import index was at $83.0/t CFR southern China ports, down $4.0/t compared with the previous week.

Market Sentiment: Market sentiment remained bearish as buyers adopted a wait-and-see approach due to ongoing price declines and high domestic coal stocks. Some miners raised prices to test the market following increased safety inspections and marginal demand recovery from chemical plants. However, the overall downtrend is expected to continue, albeit at a slower pace, due to supply constraints ahead of the "Two Sessions".

Import Market: The import market saw a divergence between low-CV and high-CV coal prices. Low-CV coal prices remained firm due to supply disruptions and rising freight rates, while high-CV coal prices continued to decline due to weak demand and cost-effective domestic supplies. Chinese interest in the seaborne import market may weaken further due to high domestic coal stocks and uncertainties related to the transition to HBA-linked coal export policies.

More details in our latest weekly thermal coal review, incl. our weekly survey on thermal coal mines, market changes and updates on coal consumption in domestream sectors. »CLICK HERE

Coking Coal

Market Overview: China's coking coal market softened last week, with prices remaining range-bound. Coking plants and some middlemen's increased restocking efforts boosted spot trading activity and caused slight price increases for certain grades. However, sentiment deteriorated mid-week due to falling coke prices, which reduced coke-making profits and led to expanded production cuts. Weak end-user demand further pressured the market, resulting in difficulties for miners in offloading stocks.

Supply and Demand: Coking coal supply saw modest growth as some mines resumed operations. Raw coking coal output at 363 surveyed mines increased by 0.08% week-on-week to 12.87 million tonnes, with capacity utilization averaging 89.55%. However, demand remained volatile. While some low-stock coking plants slightly increased purchases, most showed little interest in spot supplies, maintaining low feed coal inventories.

Inventory: Coking coal inventories at surveyed mines and plants showed mixed trends. Raw coking coal stocks at the 363 mines decreased by 1.60% week-on-week to 4.31 million tonnes, while washed coal stocks fell by 1.24% to 4.77 million tonnes. Coking coal stocks at 108 surveyed coking plants could sustain 6.66 days of usage, up 0.12 day from the previous week. Despite some regions experiencing stock accumulation, rapid price declines in Shanxi helped deplete stocks at several mines.

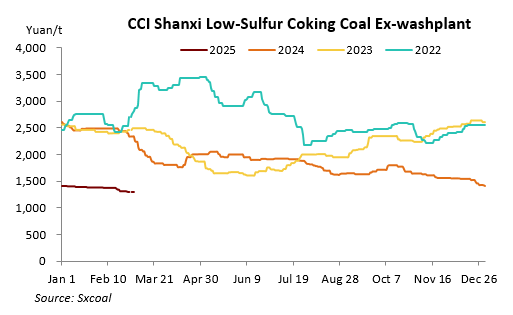

Prices: In Shanxi, coking coal prices fluctuated within a narrow range. Luliang high-sulfur lean coking coal prices increased to 1,030 yuan/t, while Linfen low-sulfur primary coking coal prices fell to 1,310 yuan/t. In Inner Mongolia, prices were adjusted downward by 60-100 yuan/t due to weak demand. In Shandong, washed gas coal prices remained stable at around 1,040 yuan/t.

Mongolian Coal: Mongolian coal inflows through China's Ganqimaodu border crossing declined notably due to high inventory levels, with daily customs clearance averaging 790 trucks over February 24-27, down 233 trucks week-on-week. Spot prices for Mongolian 5# raw coal fell to 880-890 yuan/t.

Seaborne Imports: Australian low-vol hard coking coal traded at around $187/t FOB, equivalent to about 1,660 yuan/t CFR China with VAT. However, spot prices for Australian low-vol hard coking coal at northern ports fell to 1,440-1,450 yuan/t due to subdued market sentiment and favorable domestic pricing.

More details in our latest weekly coking coal review, incl. our weekly survey on coking coal mines, market dynamics, etc. »CLICK HERE

Met Coke

Market Overview: China's metallurgical coke market saw marginal improvements following the implementation of the 10th price reduction of 50-55 yuan/t. Despite these reductions, coke supply remained high, overshadowing limited demand growth. The slow recovery of molten iron output at steel mills is a primary factor constraining demand.

Production side: Coke-making margins continued to shrink among coking plants after the 10th price cut, with increasing numbers of plants operating at a loss. A survey by Sxcoal of 323 coking plants showed increased losses for the week ending February 26. Some producers curtailed production due to modest demand and negative margins, but overall coke supply remained ample as most enterprises operated near breakeven levels.

Port: Traders at eastern transfer ports displayed a weakening appetite for coke due to downward futures prices, which eroded their arbitraging room. Coke stock accumulation slowed due to insufficient storage capacity at the ports. High-stocked steel mills pressured traders for more discounts, leading to a large gap between offers and bids, and actual transactions dwindled.

Demand side: Demand for coke remained constrained by limited growth from traders and steelmakers. At steel mills, coke inventories decreased at a slower pace as they slightly raised purchases following the resumption of construction activities after the holiday shutdowns.

More details in our latest weekly met coke review, incl. our weekly survey on coking plants, market dynamics, etc. »CLICK HERE

The above updates are also available in our newsletter China Coal Weekly, which provides in-depth analysis and commentaries, as well as market highlights in coal and related industries.

Meanwhile, our Weekly EXCEL Supplement keeps you updated on the CCI Thermal and Coking Coal, Met Coke indexes, prices at main production areas and transfer ports, key weekly and monthly statistical data on coal and related industries (production, stocks, import & exports, etc.).

If you wish to take a trial, please sign up HERE.