Sxcoal Issue 47# | China's coal and coke markets continue to move down

Both thermal and coking coal prices fell further last week, and met coke in the 8th drop, with 9th cut anticipated...

China's thermal coal prices will likely continue to decline due to high inventories and weak demand, while the seaborne import market may see diverging trends between low- and high-CV grades. Coking coal prices are also expected to fall further amid reduced restocking and increasing supply, with another coke price cut imminent due to weak market fundamentals.

Thermal Coal

Portside Market: The portside thermal coal market in China saw sluggish transactions due to slow demand recovery and high inventories at power plants. Coal stocks at major ports such as Qinhuangdao, Jingtang, and Caofeidian increased to 26.26 million tonnes on February 14, representing a 6.5% week-on-week rise and a 45% year-on-year increase. This accumulation eroded traders' bargaining power, especially in a buyer's market.

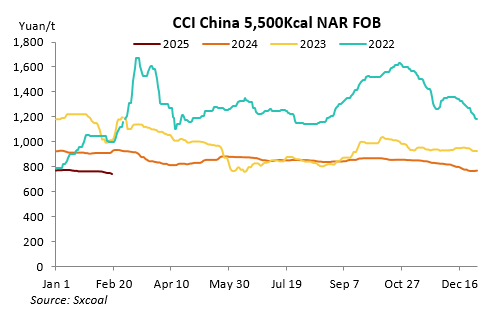

Price Trends: Domestic thermal coal prices declined significantly due to growing inventory pressure and a supply surplus. The CCI index for 5,500 Kcal/kg NAR domestic spot coal fell to 748 yuan/t FOB northern China ports, down 13 yuan/t from the pre-holiday level. The CCI 5500 Import index stood at $88.7/t, CFR southern China ports, down $2.3/t from the previous week.

Market Sentiment: Market sentiment remained bearish due to high inventories and slow downstream demand recovery. Despite cold waves in northern and eastern China, which increased coal usage at power plants, the limited strength and brief duration did not lead to significant purchases as utilities already had ample stocks.

Import Market: The seaborne import market improved as Chinese major utilities increased tenders and traders sought to cover short positions. Concerns about potential supply disruptions ahead of the Ramadan fasting season in Indonesia led to increased purchases of low-CV coal.

More details in our latest weekly thermal coal review, incl. our weekly survey on thermal coal mines, market changes and updates on coal consumption in domestream sectors. »CLICK HERE

Coking Coal

Market Overview: Coking coal supplies largely recovered to pre-Chinese New Year levels, with most mines resuming normal operations. However, market sentiment remained negative due to slow steel demand recovery and anticipated further price cuts for coke. This led to cautious buying from coke producers and a wait-and-see approach from middlemen.

Supply and Demand: Coking coal production increased significantly as mines restarted after the holiday, according to Sxcoal’s weekly survey. Coke producers prioritized depleting existing stocks, leading to lower coking coal purchases.

Inventory: Raw coking coal stocks at the surveyed mines increased 3.6% week on week to 4.35 million tonnes, while washed coal stocks rose 3.2% to 4.85 million tonnes. As of February 12, coking coal stocks at 108 surveyed coking plants could cover 6.98 days, down 0.54 days from the previous week.

Prices: Low-sulfur coking coal prices remained flat in Shanxi, while in Inner Mongolia, low-sulfur fat coal prices fell to 1,140 yuan/t. In Shandong, local washed gas coal prices retreated by 30 yuan/t to 1,040 yuan/t. Online auctions also saw setbacks, with some auctions failing to meet starting prices.

Mongolian Coal: Mongolian coal inflows through China's Ganqimaodu border crossing rebounded, averaging 1,060 trucks per day from February 10-13. However, coking coal stocks at supervision warehouses reached a record-high level, leading to overstocking and truck congestion. This pushed down Mongolian 5# raw coal prices by 20 yuan/t.

Seaborne Imports: Australian coking coal prices were slightly supported by moderate purchases from international traders, reaching $190.5/t FOB, equivalent to 1,697 yuan/t CFR China with VAT, against spot Australian hard coking coal offers at 1,440-1,470 yuan/t, ex-stock basis.

More details in our latest weekly coking coal review, incl. our weekly survey on coking coal mines, market dynamics, etc. »CLICK HERE

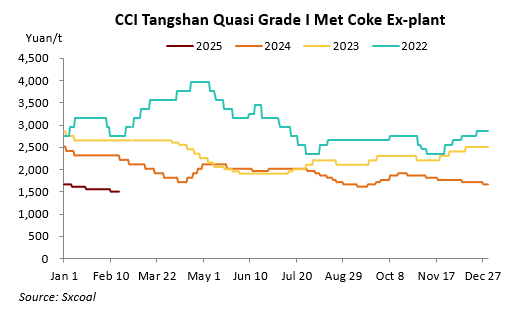

Met Coke

Market Overview: China's coke market continued to face downward pressure as the 8th round of metallurgical coke price cuts was fully implemented last week, with a reduction of 50-55 yuan/t due to sluggish demand from steel mills. Despite falling feed coal prices, coke-making profits significantly retreated, with surveyed coking plants reporting meager profit for the week ending February 12.

Production side: Coke producers experienced eroded margins, with some turning to losses. The capacity utilization of surveyed coking plants decreased by 0.58 percentage points to 75.84% over the week ended February 12. Coke inventories continued to pile up at coking plants, rising 6.7% in the week to February 12. The growing number of loss-making producers and increasing sales pressure led more companies to control production.

Port: Pessimistic sentiment prevailed in the domestic coke market, with steel mills showing lackluster buying interest. As a result, traders were reluctant to secure cargo at eastern transfer ports. Coke producers faced mounting inventory pressure, and some diverted stocks to ports.

Demand side: The slow recovery of construction projects restrained finished steel trading liquidity. Some mills added more blast furnaces to maintenance activities, stabilizing the capacity utilization rate at 78% or so as of February 14. Steel prices trended downward due to weak demand.

More details in our latest weekly met coke review, incl. our weekly survey on coking plants, market dynamics, etc. »CLICK HERE

The above updates are also available in our newsletter China Coal Weekly, which provides in-depth analysis and commentaries, as well as market highlights in coal and related industries.

Meanwhile, our Weekly EXCEL Supplement keeps you updated on the CCI Thermal and Coking Coal, Met Coke indexes, prices at main production areas and transfer ports, key weekly and monthly statistical data on coal and related industries (production, stocks, import & exports, etc.).

If you wish to take a trial, please sign up HERE.