Sxcoal Issue 45# | China thermal coal shifts down; coking coal and coke largely stable

China's portside thermal coal prices shifted downwards again last week after a short-lived recovery, while import market further slid; coking coal and met coke markets tempoarily stable.

China's thermal coal market is projected to decline gradually or stabilize around Chinese New Year, while further weakness is expected for imports due to lower demand. The coking coal market is anticipated to slow as pre-holiday restocking concludes, with prices stabilizing due to mine production suspensions. Steelmakers' push for a further 50-55 yuan/t coke price cut are most likely to materialize, bringing the total decrease to 350-385 yuan/t since late October 2024.

Thermal Coal

Portside Market: China's portside thermal coal prices declined last week due to sluggish trading activities and sporadic purchases. Sellers reduced prices to liquidate inventory before the market slowdown during the Chinese New Year. The combined coal inventory at Qinhuangdao, Jingtang, and Caofeidian increased by 1.41% week on week to 23.77 million tonnes as of January 17, despite being 7.66% lower than the previous month.

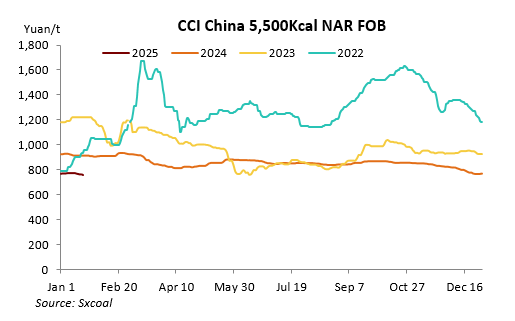

Price Trends: Prices for domestic thermal coal weakened, with the Fenwei CCI index for 5,500 Kcal/kg NAR coal falling to 765 yuan/t FOB northern China port with VAT, down 7 yuan/t week on week. The Fenwei CCI 5500 Import index slid to $92.4/t CFR southern China ports, down $0.1/t from the previous week.

Market Sentiment: Market sentiment remained bearish as both supply and demand are expected to weaken around the Chinese New Year holiday. Participants anticipated a tepid market post-holiday.

Import Market: Import thermal coal prices further declined due to reduced demand from China. Indonesian miners lowered offers for 3,800 Kcal/kg NAR coal to $49.5-50/t FOB Kalimantan, but struggled to attract buyers.

More details in our latest weekly thermal coal review, incl. our weekly survey on thermal coal mines, market changes and updates on coal consumption in domestream sectors. »CLICK HERE

Coking Coal

Market Overview: China's coking coal market largely stabilized in the week. While holiday schedules announced by mines raised expectations of supply tightness, pre-holiday restocking by coking plants was insufficient due to prolonged coke price cuts. Market activity was subdued as traders and washing plants mostly left the market.

Supply and Demand: Most coking coal mines operated normally, with only a few reducing output slightly owing to poor offtakes and pre-holiday safety concerns. Raw coking coal output at 227 surveyed mines decreased by 0.30% week on week, and capacity utilization down 0.27 percentage points. Some coke producers increased feed coal purchases in anticipation of potential mine closures during the holidays, but overall demand remained cautious due to bearish sentiment about the post-holiday market.

Inventory: Coking coal stocks at 100 Sxcoal-surveyed coking plants could sustain 10.77 days of usage, up 1.98 days from the previous week. Raw coking coal stocks at surveyed mines reached 4.49 million tonnes as of January 15, up 1.58% week on week, while washed coal stocks increased by 2.10% to 4.87 million tonnes.

Prices: Prices in key regions showed mixed trends. In Shanxi, low-sulfur primary coking coal prices declined to 1,400 yuan/t. In Inner Mongolia, prices fell by 30-50 yuan/t due to weak demand from coking plants. In Shandong, prices stabilized at around 1,100 yuan/t for washed gas coal.

Mongolian Coal: Mongolian coal imports saw increased activity at some border crossings. Prices for Mongolian coal increased at Ganqimaodu border crossing, but trading activities cooled down at other ports like Ceke and Mandula due to high stock levels and cautious market sentiment.

Seaborne Imports: Seaborne coking coal imports remained under pressure. Australian hard coking coal prices declined to $190/t FOB, translating to 1,700 yuan/t CFR China with VAT, which is still higher than domestic similar-quality coal.

More details in our latest weekly coking coal review, incl. our weekly survey on coking coal mines, market dynamics, etc. »CLICK HERE

Met Coke

Market Overview: China's metallurgical coke prices stabilized last week following six consecutive reductions. Although futures prices strengthened, leading to higher steel prices, weak demand and poor margins continued to limit steel trading and molten iron output. As a result, steel mills controlled their coke purchases.

Production side: Coke producers reported improved margins due to continued price reductions in coking coal and stable coke prices. Most coke firms maintained stable production levels, with a few even slightly increasing output. The capacity utilization of the surveyed coking plants rose by 0.08 percentage points over the week ending January 15. However, coke inventories continued to accumulate due to sales constraints, rising 11.58% from the previous week.

Port: Market activities at eastern China ports slowed down due to limited cargo availability ahead of the Chinese New Year. Reduced transactions and expectations of further coke price cuts led most traders to take holiday breaks and steelmakers to adopt a cautious buying stance.

Demand side: Steel prices rebounded last week due to rising futures prices, but demand remained weak. Steel mills' coke inventories reached multi-year highs due to weak consumption and active shipments from coking plants, with some mills struggling to unload incoming material.

More details in our latest weekly met coke review, incl. our weekly survey on coking plants, market dynamics, etc. »CLICK HERE

The above updates are also available in our newsletter China Coal Weekly, which provides in-depth analysis and commentaries, as well as market highlights in coal and related industries.

Meanwhile, our Weekly EXCEL Supplement keeps you updated on the CCI Thermal and Coking Coal, Met Coke indexes, prices at main production areas and transfer ports, key weekly and monthly statistical data on coal and related industries (production, stocks, import & exports, etc.).

If you wish to take a trial, please sign up HERE.