Sxcoal Issue 43# | China thermal coal market edges up, but import prices down

Thermal coal price increases at Chinese ports slightly lost steam; coking coal continued to decline; met coke in sixth price reduction.

China's thermal coal market is expected to see diverging trends in low- and high-CV grades; limited import market adjustments are also anticipated. The coking coal market is forecast to decline further this week due to pessimistic sentiment from steel and coke producers and limited pre-Spring Festival restocking. The coke market is also unlikely to improve before the holiday due to high production, weak demand, and downward coking coal prices.

Thermal Coal

Portside Market: Thermal coal price increases at Chinese ports slightly lost momentum last week, especially for high-CV grades due to sluggish inquiries. However, low-CV coal grades still saw bigger upticks backed by a supply shortage. The overall coal inventory at Qinhuangdao, Jingtang, and Caofeidian ports remained on the downward trend, standing at 23.44 million tonnes on Jan 10, down 0.68% from a week ago.

Price Trends: On January 10, the Fenwei CCI index for 5,500 Kcal/kg NAR domestic spot coal stood at 772 yuan/t FOB northern China port with VAT, rising 5 yuan/t week on week. The Fenwei CCI 5500 Import index stood at $92.5/t, CFR south China port, down $0.2/t compared with the previous week.

Market Sentiment: Some participants warned of possible downward corrections for prices of high-CV coal in the near term due to persistent lukewarm transactions and rising selling pressure. Miners were generally reluctant to lower prices in anticipation of a supply contraction as some small mines are about to start their holiday break.

Import Market: Imported thermal coal prices retreated last week, partly dragged down by weak demand from major power plants in China and India. As of January 10, Sxcoal assessed 3,800 Kcal/kg NAR tender winning prices at 458 yuan/t, CFR with VAT, down 3 yuan/t week on week. China's demand for Australian high-CV coal has picked up since New Year's Day, particularly from cement producers in southern China.

More details in our latest weekly thermal coal review, incl. our weekly survey on thermal coal mines, market changes and updates on coal consumption in domestream sectors. »CLICK HERE

Coking Coal

Market Overview: China's coking coal market continued to decline last week, driven by factors such as the resumption of production at most halted mines post-New Year's Day, declining molten iron output following blast furnace maintenance, and recent coke price cuts.

Supply and Demand: The supply of coking coal further recovered as mines that had suspended or cut production after reaching annual goals in late 2024 restarted operations concentratedly in early January. However, demand was weak due to the lack of positive expectations of macroeconomic policies, reducing steel prices, and the cautious buying stance of coke producers and steel mills.

Inventory: Coking coal stocks at 100 Sxcoal-surveyed coking plants could sustain 8.79 days of usage as of January 8, up 0.38 day from the previous week. Raw coking coal stocks at 359 surveyed mines reached 4.42 million tonnes as of January 8, up 4.67% week on week, while washed coal stocks increased by 6.59% on the week to 4.77 million tonnes.

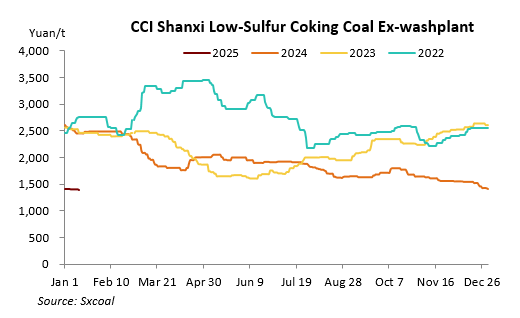

Prices: Prices for various grades of coking coal fell in different regions. In Shanxi, low-sulfur primary coking coal slumped 380 yuan/t since mid-October to 1,420 yuan/t. In Inner Mongolia, one miner in Qipanjing concluded online auctions of low-sulfur fat coal at 1,220 yuan/t on January 9, falling 30 yuan/t from January 2.

Mongolian Coal: Mongolian coal inflows at three major China-Mongolia border ports gradually resumed. However, amidst the ongoing decline of both coke and mine-mouth coking coal prices, downstream buyers exercised caution in purchases and sought lower prices. Prevailing prices for Mongolian 5# raw coal under long-term contracts fell 10 yuan/t from the previous week.

Seaborne Imports: International end users prioritized buying coking coal on a need-to basis. Combined with supplies from other countries, Australian coal transactions languished last week. Australian hard coking coal was traded at $196/t FOB, down $7.5/t week on week, translating to 1,754 yuan/t CFR China with VAT, still higher than domestic equivalents.

More details in our latest weekly coking coal review, incl. our weekly survey on coking coal mines, market dynamics, etc. »CLICK HERE

Met Coke

Market Overview: China's metallurgical coke market saw the sixth round of price reductions, with a total decline of 300-330 yuan/t since late October 2024. This reduced overall profits in coke-making. A survey by Sxcoal of 100 coking plants showed an average profit of 41 yuan/t for the week ending January 8, a 31 yuan/t drop from the preceding week.

Production side: Most coke firms maintained stable production last week, with a few scaling down due to contracted gains or unprofitable operations. Some coke makers in Shandong slightly lifted output after the end of localized environmental warnings. The capacity utilization of surveyed coking plants ticked up by 0.05 percentage point over the week ended January 8.

Port: Coke stocks accumulated in major producing regions due to slack buying at steel mills, leading some coke makers to transfer their inventories to eastern China ports. However, portside trading liquidity remained thin owing to a large gap between buying and selling prices.

Demand side: The coke market remained under pressure from weak demand. Steel mills exhibited lower buying enthusiasm for coke in line with decreased molten iron production and ample raw material stocks. Steel prices moved downside broadly last week amid continuous weak supply-demand fundamentals.

More details in our latest weekly met coke review, incl. our weekly survey on coking plants, market dynamics, etc. »CLICK HERE

The above updates are also available in our newsletter China Coal Weekly, which provides in-depth analysis and commentaries, as well as market highlights in coal and related industries.

Meanwhile, our Weekly EXCEL Supplement keeps you updated on the CCI Thermal and Coking Coal, Met Coke indexes, prices at main production areas and transfer ports, key weekly and monthly statistical data on coal and related industries (production, stocks, import & exports, etc.).

If you wish to take a trial, please sign up HERE.