Sxcoal Issue 41# | China thermal coal market rebounds; coking coal and coke prices drop further

China's thermal coal market edged up slightly last week after falling to 1.5-year low, while coking coal and met coke continued to move lower.

China's thermal coal market is projected to remain stable or even edge up this week due to easing bearish sentiment, short-covering, and lower port inventories, potentially stabilizing the import market as well. In contrast, the coking coal market will likely face continued downward pressure, due to weak demand after the 5th coke price cut and potential increases in mine inventories. Metallurgical coke prices may also be under pressure due to limited steelmaker procurement.

Thermal Coal

Portside Market: China's thermal coal prices showed a "V-shaped" trend last week, with a rebound in the second half due to reduced inventory pressure, strong resistance to further price cuts, and increased demand to cover short positions. The overall coal inventory at Qinhuangdao, Jingtang, and Caofeidian ports decreased by 4% from the previous week to 24.5 million tonnes on December 27.

Price Trends: The Fenwei CCI index for 5,500 Kcal/kg NAR domestic spot coal was 765 yuan/t FOB northern China ports with VAT on December 27, a decrease of 11 yuan/t week on week. Fenwei CCI 5500 Import index stood at $92.7/t CFR southern China ports, down $1.3/t from the previous week.

Market Sentiment: Market sentiment improved in the seaborne import market as utilities increased tendering activity, although foreign miners were mostly inactive due to the Christmas holiday. There is skepticism about the sustainability of the price rebound due to limited improvements in coal burns at power plants and sufficient on-hand stocks.

Import Market: Imported thermal coal price decline halted at the end of last week, partly due to increased buying interests from major power groups and improved sentiment in the domestic market. Chinese traders' bidding prices for 3,800 Kcal/kg NAR coal tenders declined, with the lowest bid netting back to $49.3/t FOB East Kalimantan on December 26. The freight rate for Panamax vessels on the East Kalimantan-Guangzhou route fell to $5.48/t on December 25, a significant decrease of 21% compared to the preceding month.

More details in our latest weekly thermal coal review, incl. our weekly survey on thermal coal mines, market changes and updates on coal consumption in domestream sectors. »CLICK HERE

Coking Coal

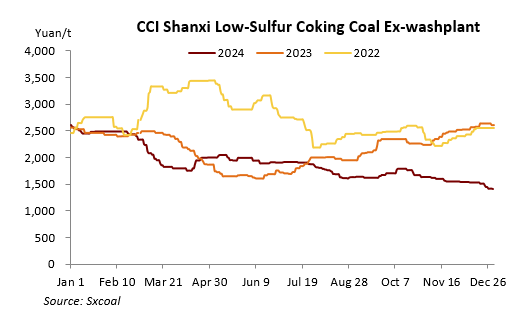

Market Overview: The Chinese coking coal market continued to decline last week due to prevailing bearish sentiment and poor offtakes. After the fifth coke price cut, coking plants reduced purchases, leading to stagnant coking coal offtakes and rising stocks, which further depressed prices.

Supply and Demand: Coking coal mines suspended or capped production due to completion of annual targets or safety concerns, leading to supply contractions. Despite this, most coking plants, having restocked to safe levels, were reluctant to buy more due to ample supply and declining feed coal prices.

Inventory: Coking coal stocks at 100 surveyed coking plants could sustain 8.09 days of usage, a slight decrease from the previous week. Raw coking coal stocks at surveyed mines reached 3.46 million tonnes as of December 25, up 2.67% week on week, while washed coal stocks increased by 4.26% to 2.69 million tonnes.

Prices: Coking coal prices trended downwards in most parts of Shanxi due to inactive purchases. Prices for low-sulfur primary coking coal in Linfen declined 90 yuan/t last week to 1,450 yuan/t, with a cumulative reduction of 350 yuan/t since mid-October. Online auctions also faced setbacks with high failure rates, and prices for certain grades hit the lowest in nearly three years.

Mongolian Coal: Mongolian coal inflows at China's Ganqimaodu border port exceeded 40 million tonnes, setting a new record. However, customs clearance activities were low due to inventory pressure. Prices for Mongolian 5# raw coal fell to 930-940 yuan/t, ex-stock Ganqimaodu with VAT, as traders faced increased offtake difficulties.

Seaborne Imports: The seaborne import market was quiet due to the Christmas holiday, with Australian hard coking coal prices slid to $190/t FOB, translating to about 1,698 yuan/t CFR China with VAT. Indian inquiries increased on December 27 due to the implementation of coke import quotas in 2025. Futures prices fluctuated downwards, affecting coke-producing profits and eroding producers' purchasing enthusiasm.

More details in our latest weekly coking coal review, incl. our weekly survey on coking coal mines, market dynamics, etc. »CLICK HERE

Met Coke

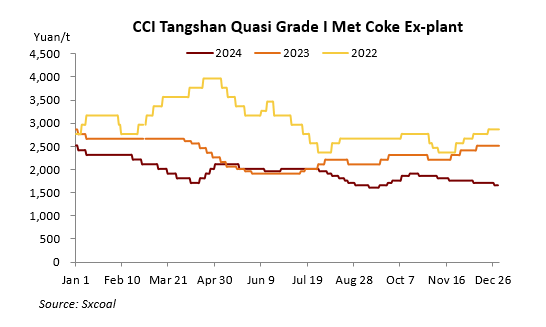

Market Overview: The Chinese metallurgical coke market witnessed its fifth consecutive price cut due to sluggish demand, bringing the total price decrease to 250-275 yuan/t since late October. Cokemakers temporary maintained normal production and deliveries, as feed coal prices have fallen more sharply than coke prices.

Production side: Profits in the coke-making sector rebounded as coking coal miners further lowered their prices. Despite this, coke demand has been capped by a decline in molten iron production. Sxcoal's survey of 100 coking plants revealed an average profit of 70 yuan/t, increasing by 20 yuan/t from the previous week. Environmental protection measures limited production at some plants, but better profits from lower feed coal prices led some firms to ease production controls slightly. The capacity utilization of surveyed coking plants increased by 0.07 percentage points.

Port: Bearish sentiment intensified at eastern ports with coke purchases constrained by a slump in molten iron production and a rapid decline in coking coal prices. Very few trades were concluded due to scarce cargo availability. The price of Quasi Grade I coke at Rizhao port fell by 30 yuan/t week on week to 1,600 yuan/t FOB with VAT.

Demand side: Steel prices generally held steady, supported by a resilient futures market. However, with limited trading liquidity and the suspension of blast furnaces, steel mills are likely to exert further downward pressure on coke prices. The capacity utilization of Sxcoal-surveyed steel mills decreased by 0.92 percentage points to 78.71%. As steelmakers reduced coke consumption and coke firms actively shipped the material to mills, the coke inventory at surveyed mills increased 0.28 days from a week ago.

More details in our latest weekly met coke review, incl. our weekly survey on coking plants, market dynamics, etc. »CLICK HERE