Sxcoal Issue 40# | China thermal and coking coal prices continue to drop; coke price may further fall

China's coal and coke markets continue to be under downward pressure from bearish sentiment.

China's coal and coke markets are under downward pressure from bearish sentiment. Domestic thermal coal prices are likely to fall further as buyers adopt a cautious stance, which may also lower import prices as power utilities push for lower costs. Additionally, weakness in the steel market and the potential for further coke price cuts will negatively impact both coking coal and metallurgical coke markets.

Thermal Coal

Portside Market: Thermal coal prices at northern ports in China continued to decline rapidly last week, due to buyers' reluctance to place orders amidst the downward price trend. Ample supply and sufficient stocks led to continuous pressure on buy prices. The combined coal inventory at Qinhuangdao, Jingtang, and Caofeidian ports decreased by 2.26% week on week as of December 20, reflecting ongoing destocking efforts.

Price Trends: The Fenwei CCI index for 5,500 Kcal/kg NAR domestic spot coal fell by 23 yuan/t week on week to 776 yuan/t FOB northern China ports with VAT. Fenwei CCI 5500 Import index decreased by $2.0/t to $94.0/t CFR southern China ports.

Market Sentiment: Bearish sentiment prevailed in the market, with middlemen and downstream users adopting a cautious approach. Power plants, holding high stocks, continued to lower buy prices, leading to a persistent buy-ask spread and weak transactions. Some offer prices have reached the lowest in a year and a half, with no immediate support in sight.

Import Market: Imported thermal coal prices also dipped last week due to weak demand from Chinese major power utilities and bearish domestic market sentiment. The lowest bidding prices for February-delivery 3,800 Kcal/kg NAR coal dropped to a level equating to about $50.1/t FOB East Kalimantan on a Panamax basis.

More details in our latest weekly thermal coal review, incl. our weekly survey on thermal coal mines, market changes and updates on coal consumption in domestream sectors. »CLICK HERE

Coking Coal

Market Overview: China's coking coal market experienced a continued downtrend last week due to falling steel prices and sustained market pessimism. Coking plants showed little interest in winter storage, leading to cautious buying by traders and washing plants. This resulted in stagnant offtakes and increased stocks, with further price reductions of 30-50 yuan/t in some grades. High-priced online auctions struggled to find buyers, with most deals settling at lower prices.

Supply and Demand: As the year-end approached, most coking coal mines operated normally, but some halted or capped production after reaching annual targets, leading to a slight reduction in overall supply. Raw coking coal output at Sxcoal-surveyed mines dipped by 1.0% or so week on week. Weak seasonal demand and economic uncertainties prompted expectations of further coke price reductions, with coking plants modestly reducing purchases after recent restocking.

Inventory: Coking coal stocks at 100 surveyed coking plants could sustain 8.2 days of usage as of December 18, up 0.5 day from the previous week. Middlemen accelerated sales, resulting in sluggish trading, particularly for high-priced shipments. Sxcoal-surveyed mines' raw coking coal stocks rose 2.12% in the week ending December 18, while washed coal stocks increased by 3.2%.

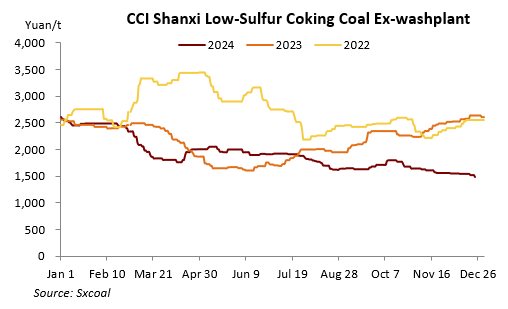

Prices: Coking coal prices moved lower in most parts of Shanxi due to bearish sentiment and falling futures and spot steel prices. Prices for low-sulfur fat coking coal in Luliang decreased by 50 yuan/t, while other grades saw smaller declines or remained stable. Online auctions faced setbacks, with high failure rates and lower transaction prices.

Mongolian Coal: Daily customs clearance at China's Ganqimaodu border crossing decreased, and despite diminishing Mongolian coal inflows, coal stocks at supervision warehouses remained high. Weakness in China's domestic market pushed down Mongolian coal prices, with many deals concluded at lower prices.

Seaborne Imports: Despite subdued demand, Australian coal prices largely stabilized due to seasonal tightness in supply. Australian hard coking coal was traded at $206.2/t FOB, translating to about 1,829 yuan/t CFR China with VAT, far higher than domestic equivalents. Slumping futures prices and potential fifth coke price cut made coking plants refrain from restocking, significantly dampening spot transactions at northern ports.

More details in our latest weekly coking coal review, incl. our weekly survey on coking coal mines, market dynamics, etc. »CLICK HERE

Met Coke

Market Overview: China's metallurgical coke market continued to face weak supply-demand fundamentals last week, with prices leveling off after a fourth price cut. Despite some improvement in coke-making profits due to lower feed coal prices, the market was still under pressure from ample supply and insufficient demand.

Production side: Coking plant profits increased slightly, but some plants still reported losses. Most producers maintained high production levels, although some reduced output due to losses or stricter environmental regulations. The capacity utilization of surveyed coking plants decreased by 0.84 percentage points, and their coke stocks declined by 1.26%, marking a two-week consecutive decline.

Port: Coke prices at eastern China ports dropped as market participants became bearish due to scarce cargo availability and downward futures prices. Portside transactions were stagnant, with buyers making small inquiries and offering lower prices.

Demand side: Most steelmakers purchased coke on a need-to basis, with enough inventory to cover more than 12 days. Steel prices trended downward due to concerns about domestic demand during the traditional off-peak season and diminishing cost support. The daily transaction of construction steel slid 5.28% from the previous week.

More details in our latest weekly met coke review, incl. our weekly survey on coking plants, market dynamics, etc. »CLICK HERE