Sxcoal Issue 38# | China thermal and coking coal further drop; met coke under pressure

China's thermal and coking coal prices dropped further amid weak demand, met coke faced pressure for 4th price cut.

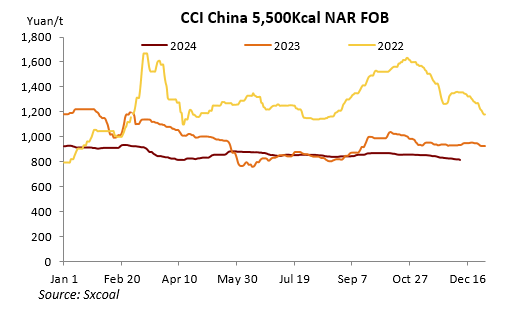

Thermal Coal

Portside Market: Thermal coal prices at northern China ports further declined due to weak demand and high de-stocking pressures. The limited liquidity at ports, along with a major miner's reduction in third-party coal prices, led to a price decrease among other miners. The bearish sentiment at the portside market was further exacerbated by a sharp drop in the number of vessels anchoring and expected to arrive, indicating lukewarm demand from both power plants and non-power users.

Price Trends: The Fenwei CCI index for 5,500 Kcal/kg NAR domestic spot coal was 818 yuan/t FOB northern China ports with VAT, falling 7 yuan/t week on week; the Fenwei CCI 5500 Import index stood at $101.2/t, CFR southern China ports, down $1.8/t from the previous week.

Market Sentiment: The market sentiment remained bearish, with miners cutting prices in response to tepid demand and low purchase prices from end-users. A leading miner's continued reduction in its buy prices of third-party coal has compounded the negative outlook for the near-term market.

Import Market: Imported thermal coal prices remained on the decline last week amid inactive purchases from major domestic power groups and continued decline in bidding prices to utility tenders. Low tender-winning prices prompted traders to keep pressing down their buy prices, resulting in a decline in FOB prices.

More details in our latest weekly thermal coal review, incl. our weekly survey on thermal coal mines, market changes and updates on coal consumption in domestream sectors. »CLICK HERE

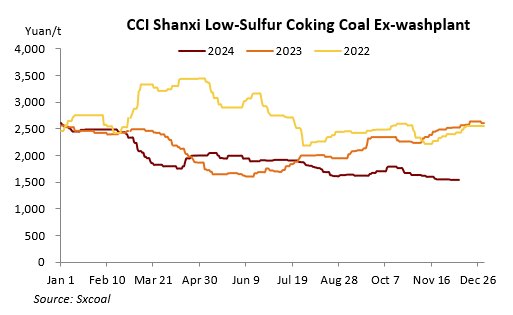

Coking Coal

Market Overview: China's coking coal market experienced a continued decline last week, with coke producers moderately increasing purchases for low-priced feed coal, which slightly boosted coal sales. Despite this, retreating futures and spot steel prices fueled expectations of further coke price cuts. This, in turn, added to the caution among coke and steel producers who avoided high-priced cargoes, further driving down coking coal prices.

Supply and Demand: Most coking coal mines operated normally, with a slight increase in overall supply as some mines resumed production. Raw coking coal output at Sxcoal-surveyed 227 mines increased by 0.22% to 9.11 million tonnes in the week ending December 4, with capacity utilization averaging 90.23%, up 0.24 percentage points week on week. Modest rebounds in steel prices helped ease market pessimism, and as winter storage approached, some coke producers slightly increased procurement.

Inventory: Raw coking coal stocks at surveyed mines reached 3.22 million tonnes as of December 4, up 0.63% on the week, while washed coal stocks decreased by 1.64% from a week ago to 2.40 million tonnes. Coking coal stocks at 100 surveyed coking plants could sustain 7.19 days of usage as of December 4, up 0.63 days from the previous week.

Prices: Coking coal prices trended downwards in most parts of Shanxi. In Luliang, prices for certain coking coal grades hit new lows for the year, encouraging some cokemakers to lift stocks moderately. High-sulfur coking coal (A 10.5%, S 3.0% GRI 85) was traded at 1,220-1,240 yuan/t on December 5, down 10 yuan/t from November 29.

Mongolian Coal: Mongolian coking coal transactions languished at Ceke border port, with sustained stock accumulation at supervision warehouses. Despite price cuts by local traders, downstream buyers were reluctant to accept the current prices, resulting in stagnant transactions for multiple coking coal grades.

Seaborne Imports: Some coking coal grades settled at slightly higher premiums due to moderate overseas demand and potential weather-related supply constraints in Australia. Australian Goonyella hard coking coal trades were heard at $205.3/t FOB on December 5, translating to about 1,827 yuan/t CFR China with VAT, still higher than domestic equivalents.

More details in our latest weekly coking coal review, incl. our weekly survey on coking coal mines, market dynamics, etc. »CLICK HERE

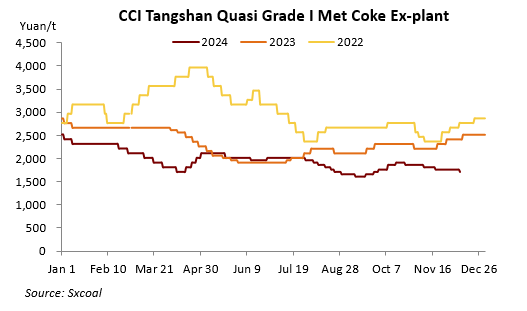

Met Coke

Market Overview: The Chinese metallurgical coke market faced increased downward pressure due to a decline in steel prices, leading to steelmakers requesting a fourth round of coke price cuts.

Production side: Coking plants in China enjoyed higher profits due to lower feed coal prices and stable coke prices, although profit growth slowed. Sxcoal's survey of 100 coking plants showed an average profit of 73 yuan/t, increasing by 11 yuan/t from the previous week. The capacity utilization of surveyed coking plants was 82.12%, and coke stocks at these plants grew by 4.8% to 712,800 tonnes.

Port: Coke prices at eastern transfer ports in China decreased last week due to thinner steelmaking margins and lower real demand. Transactions were stagnant despite inquiries. The price of Quasi Grade I coke at Rizhao port fell by 20 yuan/t to 1,640 yuan/t FOB with VAT.

Demand side: Steel prices rose earlier in the week but declined by the end, following falling futures prices. Most high-stocked steel mills maintained on-demand purchases or controlled coke arrivals, while some increased buying due to colder weather and lower stocks.

More details in our latest weekly met coke review, incl. our weekly survey on coking plants, market dynamics, etc. »CLICK HERE