Sxcoal Issue #8 | China thermal coal mines recovering from Chinese New Year holidays

China's thermal coal mines are recovering from Chinese New Year holidays, the latest Sxcoal survey shows. A few Australian cargoes have arrived at Chinese ports, and some are on the way....

Thermal coal mines are recovering operations after the weeklong Chinese New Year holidays ended late last week. This has resulted in a marked increase in coal production and mild stock build at some mines.

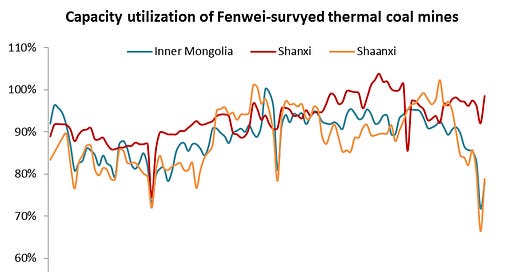

Capacity utilization at coal mines surveyed by Sxcoal climbed to 83.46% in the week ending February 1 from a low of just above 75% over the holiday week, supported by higher operations at key state-owned mines. Local state-owned and private mines still run 60-77% capacity, but we expect a substantial growth next week after the Lantern Festival this weekend.

While thermal coal prices are relatively stable in main production areas, where both supply and demand haven't fully recovered, spot prices have showed signs of decline at major N. China ports, hit by high stocks and lacklustre demand. » More details

Similarly, sufficient utility inventories and steady supplies have discouraged traders’ activities in the seaborne import market. This, together with decline in latest utility tender award prices, dragged down prices of Indonesian coal, with 3,800 Kcal/kg and 4,700 Kcal/kg NAR material assessed by Sxcoal at $78/t and $104/t CFR south China on Feb 1, down $5.5/t and $6.5/t from levels before the holiday. » More details

More Australian coal arriving

Several shipments of Austrlian coal have arrived or been en route to China, a strong indication that the two countries are gradually resuming coal trades after more than two years of stalemate.

According to Kpler's cargo-tracking data, a total of five coal cargoes were delivered, scheduled or in transit from Australia to China in January and February.

A 134,760-tonne cargo of thermal coal carried by a Capesize vessel left Australia's Hedland port on January 3 and arrived at Kemen port of China's Fujian province on January 16. » More details

Data Watch

China's top three coal-producing bases — Shanxi, Shaanxi and Inner Mongolia — have separately released their production targets for 2023, a further increase from 2022. There’s a reason behind.

Shanxi will try to raise production to 1.365 Bt in 2023 from 1.31 Bt in 2022; Inner Mongolia will increase production to 1.25 Bt from 1.17 Bt in 2022; Shaanxi will ensure production of 750 Mt this year, almost on par with last year’s 746 Mt.

China’s NBS has released statistics for Dec production of major sectors as follows.

Coal production - Dec 2022

Coke production - Dec 2022

Power generation - Dec 2022

Pig iron & crude steel - Dec 2022

More updates

Sxcoal has summaried the latest official coal import/export updates as follows:

Chinese mainland - Dec 2022

Chinese Taiwan - Dec 2022

South Korea - Dec 2022

South Africa - Dec 2022

Japan - Dec 2022

India - Nov 2022

We keep a close track of the market and publish the latest developments on our WEBSITE and in the CCI Daily newsletter (download the latest issue). If you wish to take a trial of either the web version or the newsletter, pls sign up HERE or reply to this email directly.