Sxcoal Issue 22# | Shanxi's coal production cut may signal capacity utilization normalization

China's top coal producing province of Shanxi has launched a campaign to crack down on overproduction and other illegal behaviors, a move that could result in a return to normalized utilization of...

Join us at the 2024 China Import Coal International Summit in Xiamen on March 7-8. Explore transformative trends in the global coal market, foster collaboration, and shape the future of energy. Be part of this pivotal event—sign up now!

China's top coal producing province of Shanxi has launched a campaign to crack down on overproduction and other illegal behaviors, a move that could result in a return to normalized utilization of mining capacities.

The provincial energy and mining safety regulators as well as the emergency management bureau have started a special inspection running through May 31, according to a notice jointly issued by the three government authorities on February 8.

Coal mines will face scrutiny over issues including producing beyond approved capacity, deploying unapproved longwalls, and higher-than-allowed number of miners working underground.

Specifically, coal mines' annual/monthly coal output is not allowed to exceed 110% of their approved capacities. The move, according to insiders, was to address overproduction in the past two years.

Official data showed the province's coal production reached 1.36 billion tonnes in 2023, surpassing its total capacity of operating mines (1.21 billion tonnes per annum) by 12.1%.

China, the world's top coal producer, aims to balance energy security with mining safety management, following a spate of fatal mining accidents in 2023.

Join our one-week free trial of the China Coal Market Flash on WhatsApp.

Stay ahead with up-to-the-minute updates on both domestic and import markets.

At least two Shanxi-based coal majors – Lu'an Group and Shanxi Coal International Energy Group – were reportedly required to cut production this year. However, neither have officially confirmed on this, Sxcoal has learned.

Lu'an Group, a major miner focusing on coking coal, was said asked by relevant provincial government department to reduce coal production this year by 17 million tonnes from its original plan of 103 million tonnes to 86 million tonnes.

It is worth noting that Lu'an would still commit to the fulfillment of contracted long-term volumes, which will remain unchanged at 28.23 million tonnes.

If the rumored reduction proves to be true, or even at a lower volume, the group would most likely to reduce coal sales to non-contract buyers, analysts and insiders said.

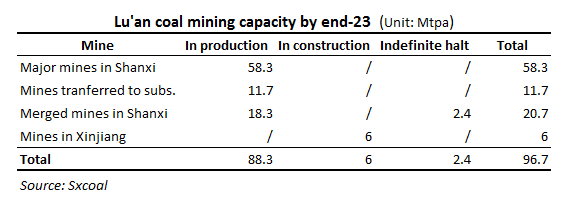

According to Sxocal's database, Lu'an had 88.3 Mtpa in operation and another 6 Mtpa in construction by the end of 2023. The group could have run 118% of operating capacity, based on last year's coal output of 104.95 million tonnes, as per data released by the China National Coal Association.

So far, Lu'an hasn't indicated any addition of new operational mining capacity in 2024, neither any closure of existing capacity, according to data available to Sxcoal. This means the group will maintain a production capacity of 88.3 Mtpa. If this year's production plan were to cut by 86 million tonnes, the rate of capacity utilization would drop to 96.74%.

Meanwhile, Shanxi Coal International Energy was said to cut production target from 40 million to 32 million tonnes in 2024, mostly thermal coal. If it also maintains its supply commitments of 25 million tonnes to long-term contract buyers, the potential reduction would also lead to a drop in sales to no-contract buyers.

The production cuts, though not confirmed by relevant companies or government officials, boosted coking coal futures by 6.19% to close at 1,748.5 yuan/t on February 21. Coke prices also posted a nearly 4% rise.

However, market sources noted Shanxi Coking Coal Group, China's largest producer of the steelmaking material, has denied any such notification for 2024. This highlighted the uncertainty and perplexity surrounding the production cuts.

Nevertheless, the Shanxi government's campaign could cast a shadow on its coal production this year. Given that most of the mines are state-owned and operated by large groups, any production reduction plans may lead to a decline in the province's coal output this year.

Should other major coal-producing provinces launch similar drives on production safety and overproduction, China's coal supply may even see a significant shrink of growth this year. This should be a boon to large exporters, such as Indonesia and Australia.