Sxcoal Issue 26# | China's thermal and coking coal markets further slide

China's thermal and coking coal prices further declined last week, owing to weak demand and worsened market sentiments

Thermal Coal

Portside Market: Portside thermal coal prices continued to decline last week, due to weak demand from power plants and high inventories. Traders reduced prices to attract orders and lower stocks, anticipating further declines as temperatures fall.

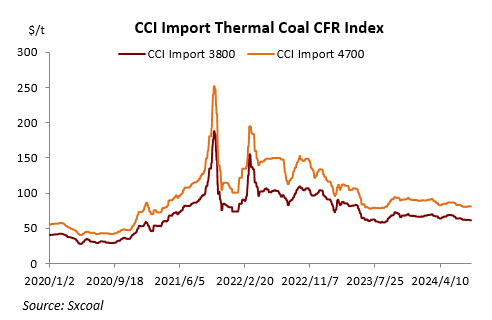

Price Trends: The Fenwei CCI Index for domestic 5,500 Kcal/kg NAR spot coal stood at 851 yuan/t FOB northern China ports with VAT on August 9, falling 4 yuan/t week on week. Imported low-CV thermal coal prices also fell as traders lowered bids for utility tenders. Southern utilities awarded tenders for September-October delivery of Panamax Indonesian 3,800 Kcal/kg NAR coal at 485-490 yuan/t DDP with VAT, netting back to about $52/t FOB Kalimantan. The Fenwei CCI 5500 Import index stood at $101.7/t, CFR south China ports, flat week on week.

Market Sentiment: Participants remained bearish about the near-term market due to low demand and limited support. Some anticipated further price reductions as inventory pressure mounts. A few traders indicated they might lower prices further to alleviate inventory pressure.

Import Market: Import market weakened, particularly for low-CV grades. Southern utilities awarded tenders for Indonesian coal at lower prices. Offers from foreign miners were above bids, limiting arbitrage opportunities. Offers for Panamax cargo of 3,800 Kcal/kg NAR coal was at $54/t FOB for August laycan, against bids at approximately $52.5-53/t.

Coking Coal

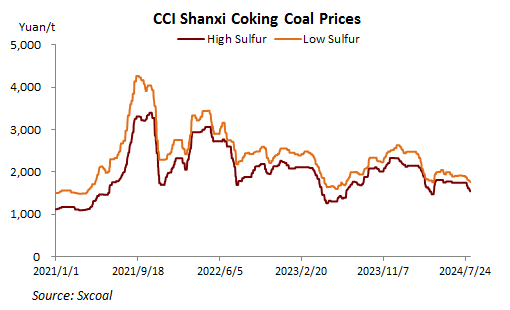

Market Overview: China's coking coal prices saw a continued decline last week, driven primarily by three rounds of coke price cuts since late July. As steel and coke producers faced worsening financial losses, they became more cautious in their coking coal purchases, amplifying sales pressures on coking coal mines despite falling prices. This heightened caution led to increased failure rates in online auctions and further price drops in the coking coal market.

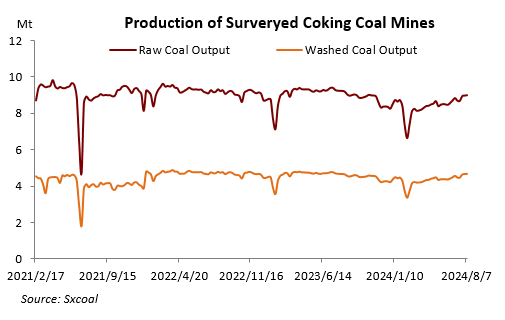

Supply and Demand: The overall supply of coking coal experienced slight increases entering August, but certain mines had to suspend operations due to adverse weather or safety/environmental inspections. Raw coking coal output at Sxcoal-surveyed mines rose marginally to 8.98 million tonnes for the week ending August 7, with average capacity utilization at 88.90%. However, steel mills are cutting back on production and engaging in maintenance due to significant losses, which has resulted in reduced purchasing enthusiasm for raw materials. Coking plants have only been buying coal to meet immediate needs, further depleting their existing stocks.

Inventory: Rising coking coal inventories at mines reflected cautious purchasing behavior from coking plants. Stocks at 100 surveyed coking plants fell to cover 5.39 days of use, a minor decline on the week, while total coking coal stocks at surveyed mines rose by 6.79% to 3.46 million tonnes. The overall market sentiment has led to high inventories at many mines, pressuring them to reduce prices further to facilitate sales.

Prices: Prices continued to decline across various regions of Shanxi, with low-sulfur fat coal prices dropping significantly. Online auctions also settled lower, indicating shifts in market dynamics. In Linfen, prices for low-sulfur primary coking coal fell cumulatively by about 140 yuan/t since late July. Traders reported low transaction volumes as bearish sentiment persisted, driven by the lack of interest from downstream buyers and the need for miners to sell coal at reduced prices.

Mongolian Coal: Mongolian coal inflows have been affected by weakened trading activity and customs disruptions. Customs clearance at Ganqimaodu averaged 988 trucks per day from August 5-8, down from the previous week. Prices for Mongolian 5# raw coal under long-term contracts decreased to around 1,220-1,230 yuan/t.

Seaborne Imports: The seaborne import market has been stagnant due to weak demand from international buyers, impacting Australian and Russian coal prices, which have both fallen in response to market conditions.