Sxcoal Issue 15# | China's thermal coal supply-demand dynamics - don't miss out!

Crucial datasets for China's thermal coal market; expert views and analyst forecasts expected in upcoming summit.

China's V-shaped thermal coal market in February came with increased surplus of supply against lacklustre demand around the Chinese New Year celebrations. Lower-than-expected industrial activity has led to a slowly downward market entering March, but how it could move going forward?

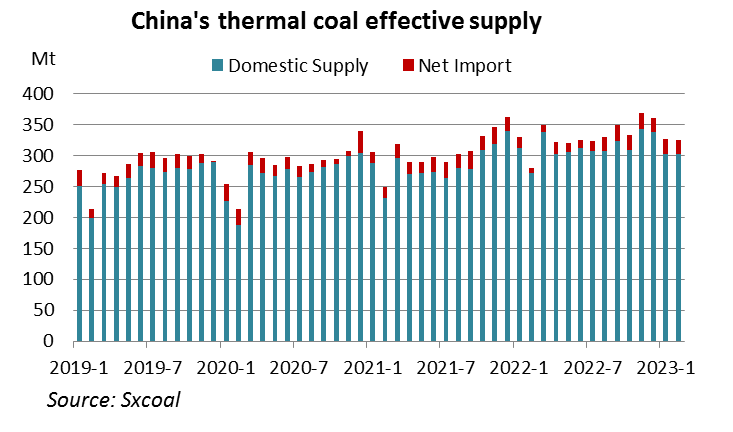

China’s thermal coal market remained in loose balance in February, with the supply exceeding the demand while both falling from a month earlier.

China's thermal coal supply reached 324.65 Mt in February, down 0.88% from January, while the demand fell 2.44% month on month to 318.47 Mt. The supply comprised domestic output 302.4 Mt (0.05% MoM), and imports 22.25 Mt (-11.98% MoM).

It is interesting to note that the domestic output remained relatively stable while imports fell significantly compared with January. However, the imports in February came at 76.75% higher than the same month a year ago.

Take one-week free trial of FLASH Service on WhatsApp for major China domestic/import coal market changes and critical data — CCI indices, bids/offers, tenders …

DM us on WhatsApp +86 186 3686 3390 or reply to this email directly.

Regarding demand, thermal coal is mainly used in sectors incl. power, metallurgy, chemical, building material and heating. Apart from a rise in pig iron and other consumption, all others registered declines, especially for consumption in chemical and cement sectors, down 8.15% and 5.82% MoM, respectively.

Both coal supply and demand were affected by the Chinese New Year holiday, but resumption was earlier in the coal sector, while consuming sectors couldn't realize a full comeback until mid-February.

The lack of demand pushed coal prices down sharply in early February, with the benchmark 5,500 Kcal/kg NAR prices down to 990 yuan/t from 1,220 yuan/t. But since mid-February, the prices bounced back along with the industrial resumption, driving the prices back to 1,190 yuan/t at the end of February.

Data behind

We have prepared the supporting data behind the above summary in a 3-page PDF file. That gives more details, incl. China’s total and top five provinces’ raw coal outputs (other bituminous coal, coking coal, anthracite and lignite), thermal and washed coking coal supplies, and thermal and coking coal supply and demand.

Such datasets are available on a monthly basis and sent to you before the end of each month. If you wish to learn more details or get a copy of the Dec 2022 numbers, please click HERE.

Market Summit

We just concluded the Global Coking Coal Summit on March 30. Some of the takeaways published on our website listed below:

China's coking coal reserves not be enough to sustain long-term demand

All export coal trades in Mongolia to go online by next year

China's Australian coking coal import growth not so optimistic

We are also considering putting part of the presentations on Youtube for your reference, please stay tuned.

Moreover, we’re going to hold the Global Thermal Coal Market Summit over Apr 19-20 in Qinhuangdao, Hebei province. Join us for more expert views and discussions on the thermal coal market. You can also attend VIRTUALLY.