Sxcoal Issue 14# | China's less volatile thermal coal market and near-term outlook

The market is by no means comparable to dramatic surges a year ago, despite the lifting of strict COVID prevention measures...

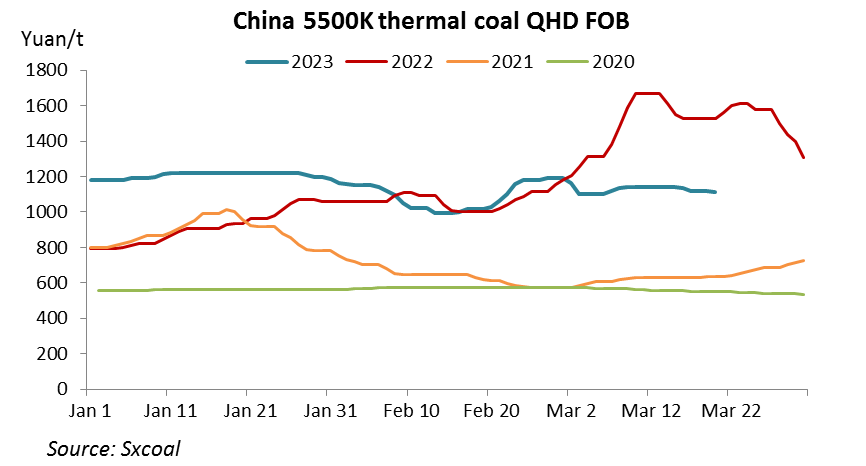

China's thermal coal market has been much less volatile since March, if compared with February and a year ago, but its slow and steady downside reflects changing market fundamentals and a less optimistic near-term outlook.

The market is by no means comparable to dramatic surges a year ago, despite the lifting of strict COVID prevention measures. Clearly, the reasons behind vary greatly and are beyond our anticipations. We are more keen to know why such changes happen and what implications we may draw from.

Against expectations of post-holiday industrial resilience, thermal coal prices have dropped 70-100 yuan/t at northern China ports since entering March, though upticks did appear briefly. This followed a V-shaped move from late January, and was just opposite to steep rises in the same period last year, which was partly owing to ripple effect from the international market.

It also differed quite a lot from a longer span of another V-shaped trend starting from mid-January till mid-May 2021, and an almost flat yet downside pattern around the same period in 2020.

Take one-week free trial of FLASH Service on WhatsApp for major China domestic/import coal market changes and critical data — CCI indices, bids/offers, tenders …

DM us on WhatsApp +86 186 3686 3390 or reply to this email directly.

Admittedly, "big picture" factors, e.g. the COVID pandemic and the Russia-Ukraine conflict, have greatly impacted the Chinese market. Profound changes of the past three years altered the supply-demand dynamics and prompted the Chinese government to adopt a series of policy measures to counter potential risks.

China's regulative measures helped protect its domestic market from the more turbulent international market. Efforts to boost coal output by tapping into potentials of existing mines and approving new mines have added substantial mining capacities in recent years.

This helped China to maintain high level of production from the last quarter 2021 till today and well into the next few years. The country produced 730 million tonnes of the fossil fuel in the first two months this year, representing a year-on-year growth of 5.82%, with daily output averaging 12.44 million tonnes.

Moreover, China imported more coal from other countries, at 60.64 million tonnes in January-February this year, growing 70.8% year on year. The huge growth was mainly from Indonesia, which banned exports in January last year to ensure domestic supplies.

While the overall supply increased substantially, demand from major sectors didn't recover rapidly as expected in the post-pandemic era. China's thermal power generation, primarily coal-fired, even dropped 2.26% year on year to 975.66 TWh in the first two months.

What next?

China's less volatile coal market has been mainly a result of close regulative supervision of the government, especially in peak demand seasons. It is relatively fast and effective, though against market norms sometimes. But, given abnormality of the market in recent years, it seems to be a workable solution.

For the near-term market, we are still not so optimistic. Coal production is more likely to stay high after the end of winter heating season, given the scale of mining capacities even the government eases requirement for supply boost.

Yet, there are several factors that would help prevent it from large drops in the seasonal lull: 1) Relatively stable mine-mouth market on inelastic demand; 2) Traders' will to uphold prices on high delivered cost to ports; 3) Restocking demand prior to the month-long maintenance to Daqin line starting in early April; 4) Continued improvements in industrial sectors; and 5) Potential decline of hydropower output on less rainfall.

We’re going to hold Global Thermal Coal Market Summit over Apr 19-20 in Qinhuangdao, Hebei province. Join us for more expert views and discussions on the thermal coal market.

You can also attend VIRTUALLY.