Sxcoal Issue 25# | Int'l thermal coal market rises further as demand rebounds in Asia

The international thermal coal market was on the rise last week, supported by improving demand from Asian countries like China, India and Vietnam.

Supply Side

Indonesia Indonesian thermal coal miners kept firm on prices amid the bullish seaborne market. As of late last week, prevailing offer prices for Indonesian Panamax 3,800 Kcal/kg NAR stood at around $59-60/t FOB, and some offers at a high of $61/t.

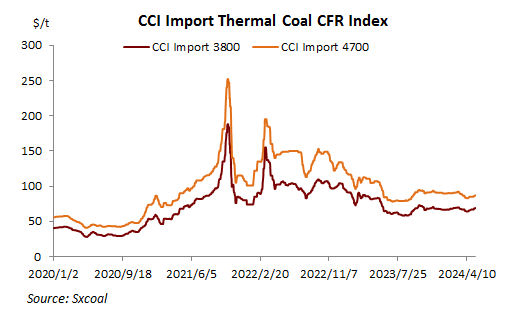

On May 10, the CCI index for Indonesian 3,800 Kcal/kg NAR coal stood at $56.5/t FOB, up $0.3/t from the previous week and $1.5/t month on month; the CCI Import 4700 index stood at $77/t FOB, up $1/t week on week and $1.3/t on the month.

Adverse weather conditions disrupted Indonesian coal production and shipment in major producing regions, with heavy rainfall causing floods in some mines.

After the May Day holiday, some Chinese utilities started restocking coal for the upcoming peak summer season. The import market rose alongside China's domestic market. Indian buyers also hastened their restocking before the monsoon season, despite sufficient domestic supply.

Russia Russian 5,500 Kcal/kg NAR thermal coal prices were up by $4/t on the week to around $87/t FOB Far East ports in the Asia-Pacific market as of late last week, driven by increased inquiries from Chinese buyers.

On May 10, Sxcoal assessed Russian 5,000 Kcal/kg NAR thermal coal at $83.5/t FOB Far East ports, up $1/t from a week ago and month on month; Russian 5,500 Kcal/kg NAR coal was assessed at $93.5/t, also up $1/t week on week and from a month earlier.

Russian exporters have highlighted the ongoing issue of low coal stocks at Far East ports, attributed to rail capacity limitations in recent months. Traders have noted that Russian coal scheduled for mid-June loading is nearly fully sold out, prompting a shift in focus towards sales for end-June and July laycans.

Australia Australian thermal coal prices remained robust last week owing to a demand rise from India and Vietnam. As of May 10, Newcastle thermal coal was priced at $146.8/t, up $1.1/t from the previous week and $17.5/t month on month.

However, Japan, a major importer for Australian coal, had lower buying interest due to high stocks domestically and off-season power demand. Meanwhile, Japan's Kansai Electric shut down a 900-MW coal-based power plant and would not resume it until end-May, which may further dampen Japanese coal demand.

South Africa Prices for South African 6,000 Kcal/kg NAR thermal coal edged up last week because of positive expectations of rising demand among Indian buyers. As of May 10, the Richards Bay Coal Terminal (RBCT) thermal coal rose $1.6/t week on week at $102.9/t FOB, which was $0.8/t higher than the previous month.

Market participants observed a decrease in demand from South Korean and Pakistan buyers, while India reported the highest average coal-fired power capacity in April due to extremely high temperatures, reaching 160 GW. This led to a rapid decline in coal stocks at power plants.

Some industry insiders suggested that the increase in Indian demand might not significantly impact the South African market as Indonesia remains India's primary source of coal imports.

We kept a close track of the market and publish the latest developments on our website and in the CCI Daily newsletter. If you wish to take a trial of either the web version or the newsletter, pls sign up HERE or reply to this email directly.

Demand Side

China Offer prices for imported thermal coal in China continued the upward trend, aligning with the Chinese domestic market and backed by a bullish market outlook. As of late last week, the awarded prices of 3,800 Kcal/kg NAR coal stood at around 560 yuan/t, DDP with VAT.

On May 11, Sxcoal assessed 3,800 Kcal/kg NAR coal at $68.5/t CFR South China, up $1.8/t from a week ago; the 4,700 Kcal/kg NAR coal was assessed at $86.5/t, up $1.5/t week on week; 5,500 Kcal/kg NAR coal was assessed at $106.5/t CFR, up $1.5/t week on week.

Sentiment in the imported coal market improved last week , with increased purchasing intentions from power plants leading to a noticeable rebound in imported coal prices. Domestic coal prices rose significantly earlier in the week, leading to increased profitability in imported coal. Traders thus increased bids for utility tenders and the awarded prices also rose.

Some plants reduced their tenders due to increased rainfall in southern China supporting hydropower generation, while most plants focused on purchasing Indonesian low-CV coal for June loading. By the end of the week, the rise in imported thermal coal prices eased to some extent.

Japan and South Korea Japan's power demand was stable week on week at 76.9 GW over May 3-9, which was 2.4 GW higher than the average for the same period in the past four years. The average coal-fired power capacity in Japan fell from 16.4 GW a week ago to 16 GW. Moreover, natural gas power generation increased by 3% from the previous week, and nuclear generation remained unchanged.

According to data from South Korea's power transmission system operator, from May 6 to 12, the expected operational coal-fired power capacity in South Korea was 20.7 GW, flat from a week ago. In the week ending May 9, the average peak power demand in South Korea stood at 62.8 GW, basically unchanged week on week.

Europe As of late last week, European 6,000 Kcal/kg NAR thermal coal prices at ARA terminals rebounded above $107/t, up around $5/t week on week. In the following months, European demand for spot supplies is projected to remain weak due to continued drops in operating profits at utilities with the downward market.

Germany's coal-fired power capacity averaged 1.7 GW last week, stable week on week. The local meteorological agency predicted the average temperature in the next two weeks to be 2.5 degrees Celsius higher than the corresponding period in previous years.

Natural gas prices increased earlier last week before a decline in the second half of the week. As of late last week, gas futures for May delivery at the European benchmark TTF hub were closed at 30.029 euro/MWh, down 1.63% from a week earlier. The highest level during the week reached 31.801 euro/MWh.

Join our one-week free trial of the China Coal Market Flash on WhatsApp.

Stay ahead with up-to-the-minute updates on both domestic and import markets.