Sxcoal Issue 17# | How China's coal imports shifting after lifting of Australian coal ban?

How China's coal import dynamic has changed this year after the lifting of a two-year-plus unofficial ban on Australian coal? Here are some of our observations.

Join our Whatsapp Channel – Sxcoal Market Tracker

to receive more timely updates on the Chinese and international coal market.

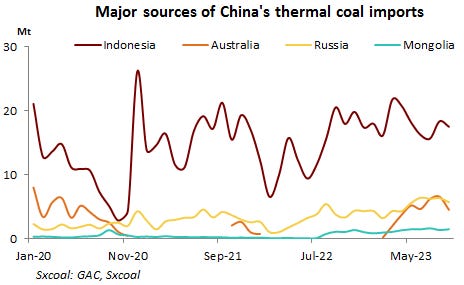

China's coal imports from Australia recovered this year following the lifting of a two-year-plus unofficial ban on Australian coal. This, combined with still resilient receipts from Russia, contributed to a decline in the share of Indonesian coal in the Chinese import market.

China lifted all the curbs earlier this year, which had been in place since the fourth quarter of 2020. The first ship carrying 66,000 tonnes of Australian coal arrived in China in February, followed by the customs clearance of Australian energy resources including coal in March.

Concerns were once raised by some analysts that the resumption of Australian coal imports could impact Mongolian and Russian coking coal shipments to China.

However, China's intakes of coking coal from Australia have not rebounded strongly. Instead, thermal coal accounted for the vast majority.

Chinese customs data showed the proportion of coking coal in the total import volume of Australian coal dropped from 30-50% in 2020 to less than 10%, indicating a slow recovery.

In contrast, China's imports of Australian thermal coal have rapidly increased since March. The monthly import volume of thermal coal (incl. other bituminous coal and other coal) from March to September averaged 4.65 million tonnes, surpassing the monthly average of 3.81 million tonnes in 2019 and 4.57 million tonnes in the first three quarters of 2020.

At the same time, China has recorded new highs in monthly imports of thermal coal, thanks to favorable import policies such as the zero-tariff policy. The cumulative imports of thermal coal during January-September exceeded the historical high in 2021.

As a result, the resumption of Australian coal imports impacted little on Russia and Mongolia, but buffeted the thermal coal shipments from Indonesia.

Besides Australia, Russia is also a main source of high-calorific value thermal coal deliveries to China, while Indonesia is a large seller of low- and medium-CV coal. Meanwhile, more Mongolian traders have shifted their focus to thermal coal business.

Since October 2020, China's imports of thermal coal from Russia have been on the rise as a whole, except for a temporary restriction on Russian coal shipments due to the Russia-Ukraine conflict at the beginning of 2022.

What's more, Russian thermal coal shipments to China have further increased rather than decreased since the resumption of Australian coal imports in March this year.

China's imports of Russian thermal coal soared 82.2% year on year to 38.61 million tonnes from March to September, data from the General Administration of Customs showed.

The increase was partly driven by the overall increase in imports this year, and Russian coal represented 17.8% of China's total thermal coal imports during the given period, slightly higher than 17.5% in the same period last year.

The imports of Mongolian thermal coal also skyrocketed 385.9% from 1.95 million tonnes last year to 9.48 million tonnes in March-September, taking up 4.4% of the total against last year's 1.6%.

However, arrivals of Indonesian thermal coal have shown a downward trend after an uptick in March. Over March-September, China purchased 128 million tonnes of thermal coal from Indonesia, up 35.12% on the year.

Despite the yearly increase, the figure was much lower than China's overall import growth rate of 78.53%. Indonesian coal accounted for 59.1% of China's total thermal coal imports, down from 78.2% a year earlier.

The decrease may be partly due to the Ramadan fast in Indonesia in April and the subsequent heavy rainfall, which affected coal production and port shipments. The primary reason could be the shift of demand to medium- and high-CV coal from downstream users in China.

Since June this year, most parts of China have experienced unusually high temperatures, leading to increased coal consumption at power plants. Against this backdrop, medium- to high-CV coal is more cost-effective than low-CV coal, prompting domestic power plants to buy high-CV coal from Australia and Russia, while slowing purchases from Indonesia.

As such, the increase in imports of high-calorific coal from Australia and Russia has squeezed the market share of Indonesian coal significantly in 2023.

Will China's imports of high-CV coal continue to increase, further squeezing the market space for low-CV coal from Indonesia next year? Our analysts will elaborate on this in our upcoming annual report 2023 China Thermal Coal Market Study and 2024 Outlook.

Our comprehensive report dissects and deciphers the crucial policy measures that shaped the coal industry's trajectory in 2023. With meticulous analysis and insightful forecasts, we leave no stone unturned in our examination of the policy environment, supply and demand dynamics, market prices, as well as imports and exports.

Don't miss this opportunity to gain a competitive edge in the ever-evolving thermal coal market. Pre-order our annual report to enjoy early bird discount at inquiry@fwenergy.com or just reply to this email.

Take one-week free trial of FLASH Service on WhatsApp for major China domestic/import coal market changes and critical data — CCI indices, bids/offers, tenders …

DM us on WhatsApp +86 186 3686 3390 or reply to this email directly.